2024 Aircraft Bonus Depreciation: Maximize Tax Benefits Before Further Phasedowns

Related Stories

Interview with an Aviator: Michele Sonier

In this special Women’s History Month edition of “Interview with an Aviator,” Jet Linx Pilot Michele Sonier shares why she left a successful career in finance to chase her dream of flying, the challenges she faced as she transitioned into aviation, and what she loves most about flying for Jet Linx.

READ MORE

Interview with an Aviator: Rob Kolar

Jet Linx Pilot Rob Kolar shares his aviation story – from his early fascination with toy airplanes at county fairs to becoming a veteran Citation X Captain.

READ MORE

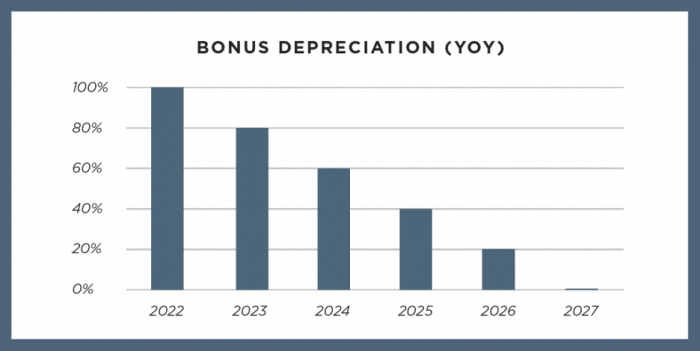

2024 Aircraft Bonus Depreciation: Maximize Tax Benefits Before Further Phasedowns

Bonus depreciation has been a game-changer for private jet ownership. Understand the evolving rules to maximize your tax benefits.

READ MORE

Related Stories

Interview with an Aviator: Michele Sonier

In this special Women’s History Month edition of “Interview with an Aviator,” Jet Linx Pilot Michele Sonier shares why she left a successful career in finance to chase her dream of flying, the challenges she faced as she transitioned into aviation, and what she loves most about flying for Jet Linx.

READ MORE

Interview with an Aviator: Rob Kolar

Jet Linx Pilot Rob Kolar shares his aviation story – from his early fascination with toy airplanes at county fairs to becoming a veteran Citation X Captain.

READ MORE

2024 Aircraft Bonus Depreciation: Maximize Tax Benefits Before Further Phasedowns

Bonus depreciation has been a game-changer for private jet ownership. Understand the evolving rules to maximize your tax benefits.

READ MORE

Contact Us